Lynk Expert Network Review

Are you an expert in your industry and looking to earn extra cash by sharing your knowledge with others? Consider joining Lynk, a leading expert network that connects industry experts with clients seeking insights on various topics. In this review, we’ll examine the pros and cons of signing up with Lynk and explore how it works.

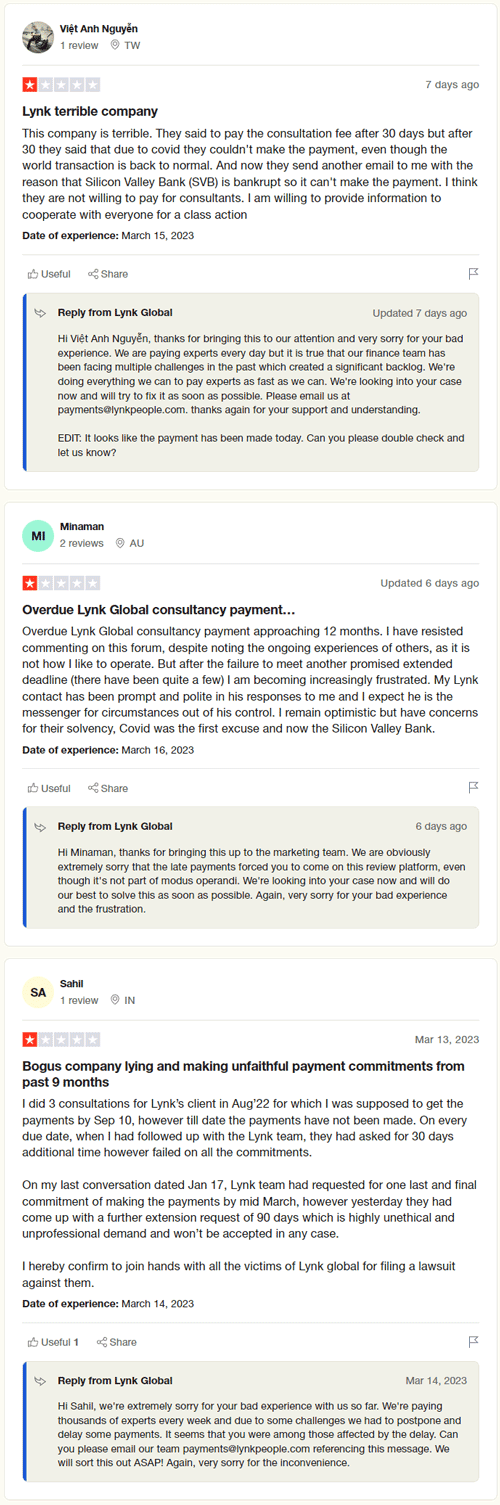

Warning of Lynk Payment Issues (updated March 2023):

New users should be cautious when signing up for the expert network Lynk because of the company’s failure to pay consultants for their services on time. Multiple reviewers have reported delayed payments of several months, and Lynk has provided excuses such as Covid-19 and the bankruptcy of Silicon Valley Bank to justify these delays. In some cases, the company has broken up payments into smaller denominations and staggered them over several months. Several reviewers have expressed frustration with Lynk’s unprofessionalism and unethical behaviour and have even expressed interest in pursuing legal action against the company. Therefore, new users should exercise caution and do their due diligence before engaging with Lynk.

Here are some of the complaints on Trustpilot:

What’s the concept?

Lynk is an expert network platform that enables users to monetize their subject matter expertise and industry experience by offering consultation services to businesses seeking expert insights. Signing up for the platform provides users with an opportunity to share their knowledge on a variety of topics, including finance, healthcare, technology, and marketing. In exchange, they receive a share of the revenue generated by Lynk, which specializes in selling expert calls, B2B surveys, and in-person meetings to clients such as hedge funds, private equity firms, and consulting firms.

Private equity firms, in particular, can benefit from the insights offered by experts on the Lynk platform. As part of their due diligence process for mergers and acquisitions (M&A), these firms often seek validation from industry experts to help inform their investment decisions.

For example, a private equity firm may be considering an acquisition of a healthcare technology company. Before making an offer, the firm may seek validation from an industry expert on the viability of the company’s products, the potential for growth in the market, and any regulatory or compliance issues that may affect the business.

By connecting with an expert on Lynk, the private equity firm can gain valuable insights to inform their investment decision. The expert, in turn, receives compensation for their time and expertise, while Lynk benefits from the revenue generated by the transaction.

In this way, Lynk offers an innovative platform that enables users to monetize their expertise while providing valuable insights to businesses seeking expert advice.

How to become an expert at Lynx Global

- Register now to create a Lynk Knowledge Profile

- Take the Lynk Expert guide and compliance tutorial

- As new requests are received, review consultation options.

- You can accept or decline any opportunity at your discretion

- Participate in consultations to get paid for your time

How to get started

Lynk employs a small army of recruiters who spend their days searching for experts who fit the criteria for client project requests. LinkedIn is their favourite hunting ground, so if your profile seems to match what they’re looking for, they’ll often reach out via LinkedIn messenger, email or a phone call to introduce you to Lynk and provide a brief overview of the consulting opportunity.

Create a profile and answer screeners

Suppose you’re interested and look like a fit. In that case, you’ll be asked to create a profile on the Lynk platform and answer a few short screening questions about your qualifications for the project, which generally requires a few sentences about your relevant work experience, knowledge of and relationship to the subject of the call.

You’ll also be asked a few yes/no compliance questions to ensure that you are permitted to speak about this topic and meet the compliance requirements set by both Lynk and the client. You’ll then have the opportunity to set your Lynk hourly rate (more on that in a moment!) and provide a list of times for a client call that is convenient for you.

Getting set up with Lynk should only take 20 – 30 minutes of your time, and then you’ll only need a few minutes to respond to additional consulting project invitations in the future.

The client decides on who to consult with

The Lynk associate will then present your profile, screening answers, rate and availability to the client. The associate will send a calendar invite for the call if they’d like to speak with you. From the first contact with the client, a call often takes less than one week. Don’t get discouraged if you’re not selected for the first project you apply for – landing about 1/3 of the relevant projects you respond to is typical with expert networks. Refining your profile and answers to screening projects can help improve your success rate.

How much will I get paid?

Signing up for the expert network Lynk can be a great opportunity for subject matter experts to monetize their skills and experience. The platform allows experts to charge a consultation fee in the range of $100 to $500 per hour for calls, and around $50 for a 10-minute B2B survey, which is a fair and competitive rate.

What’s even better is that Lynk charges clients a lower markup compared to other traditional expert networks such as GLG and AlphaSights. This results in more competitive pricing, making it easier for experts to attract clients and generate revenue. Additionally, this approach ensures that experts get a fairer share of the overall revenue generation.

In this way, signing up for Lynk as an expert is a win-win situation. Experts can earn a fair and competitive consultation fee, while clients can get access to high-quality expertise at a more affordable price point.

Knowledge scarcity impacts your consulting rate

Consider the impact of supply and demand on your rate and likelihood of being chosen for a project. If the client seeks input from users of a commonly used software package, you may face competition from numerous lower-cost consultants. However, if the client requires insights from a senior finance manager with specific experience, you may be the only viable option and able to command a higher rate. It’s recommended to set your rate at the lower end of your target range initially and gain experience and reputation before negotiating a higher rate for future projects with Lynk.

Company focused discussions

Expert calls usually focus on a specific company, industry, or product. During the call, the client typically does not expect the expert to prepare a presentation or deliverable. Instead, the client is seeking to quickly tap into the expert’s industry knowledge based on their years of experience. It’s safe to assume that clients have already conducted basic research, reviewed publicly available information, and even heard a management presentation before engaging with the expert. As such, clients typically come to the call with specific questions aimed at confirming or clarifying certain aspects of the business.

Competitor insights

The client often researches a particular company, especially those with a recent IPO, major announcement or volatile stock price. The client will be eager to learn your honest opinion about the company’s prospects, execution ability, and management quality. Frequent questions will be about how the target company compares to its competitors, product and feature differentiation, pricing strategy, quality of management, etc. These types of calls will often resolve around your former employer or a major vendor that you worked with often, with emphasis on the key factors influencing your decisions.

Industry insights

It would help if you had an easy time answering the questions during the call – the client often wants to learn about something you’ve been doing regularly for years. Even so, you may not have all the answers or know figures off the top of your head. Be honest and say you don’t know, and you should never make up answers. Clients are usually skilled at parsing fact from fiction, and manufactured responses can quickly result in a short call.

Take compliance seriously

It’s important to note that you will never be asked to share non-public or proprietary information during a client call and doing so can be illegal in more extreme cases. One of the critical responsibilities of expert networks is to ensure that improper information isn’t exchanged on a client call, with both parties bound by strict compliance standards (which you will receive before the call). All client calls are recorded by Lynk and reviewed by its compliance team (and often the client’s compliance team) to ensure that no inappropriate information is shared. Clients are usually well-versed in compliance requirements and strictly adhere to them when pursuing an investment idea.

And keep in mind that your call may be recorded and transcribed…

Expert networks like Lynk typically record and transcribe calls in order to provide their clients with access to insights from subject matter experts. During the call, the expert is usually asked a series of questions related to their area of expertise, and their responses are recorded and transcribed for future reference.

Once the call is transcribed, the content of the call becomes the intellectual property of the expert network. This means that the expert network can use the information contained in the transcript to generate additional revenue beyond the initial consultation call. For example, they may sell access to the transcript or use the information to develop a report that they sell to clients.

While expert networks may compensate experts for their time during the initial consultation call, experts typically do not receive a share of the revenue generated from the use of the transcript or any other derivative works that are created from it. This can be seen as unfair because the expert’s knowledge and expertise are what made the transcript valuable in the first place, yet they do not receive any additional compensation beyond the initial consultation call.

Furthermore, experts may be concerned about the accuracy of the transcription and the potential for their words to be taken out of context or misinterpreted. This could potentially damage their reputation and credibility as an expert in their field.

While expert networks can be a valuable tool connecting experts with clients in need of their knowledge, the potential for unfair treatment and lack of transparency around the use of recorded calls and transcriptions can be a concern.